Apple ‘Tap to Pay’ now also available in Europe

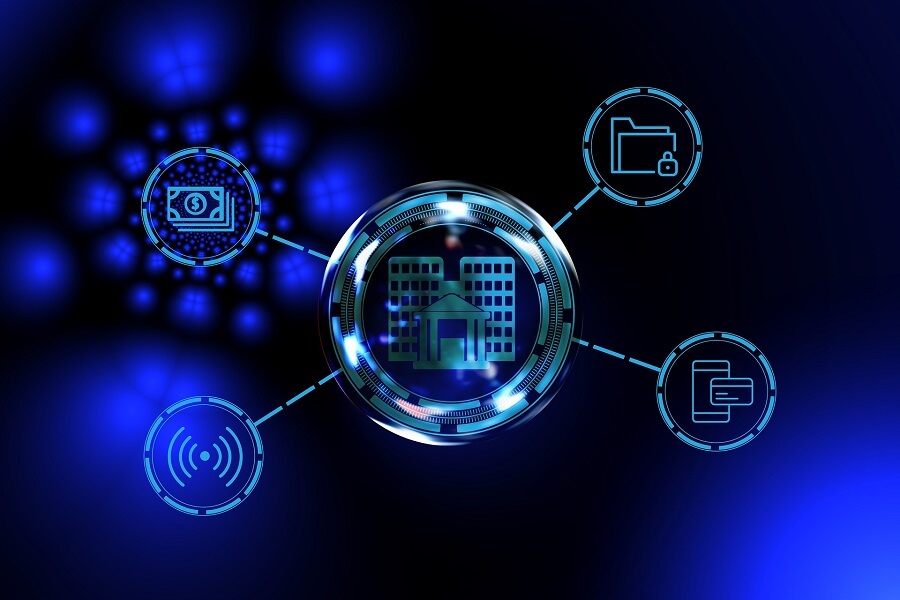

Apple is once again revolutionizing the world of digital payments. After the successful launch in the US, “Apple Tap to Pay” is now coming to Europe. This innovative feature enables small businesses and merchants to accept contactless payments directly from their iPhone, eliminating the need for additional contactless hardware. With Apple Tap to Pay, customers can simply tap their iPhone or Apple Watch to the merchant’s iPhone to make a payment. The transaction is then processed through the Apple Pay platform, known for its security and ease of use.

Apple ‘Tap to Pay’ now also available in Europe

Apple is once again revolutionizing the world of digital payments. After the successful launch in the US, “Apple Tap to Pay” is now coming to Europe. This innovative feature enables small businesses and merchants to accept contactless payments directly from their iPhone, eliminating the need for additional contactless hardware. With Apple Tap to Pay, customers can simply tap their iPhone or Apple Watch to the merchant’s iPhone to make a payment. The transaction is then processed through the Apple Pay platform, known for its security and ease of use.

How Apple Tap to Pay works

How Apple Tap to Pay works

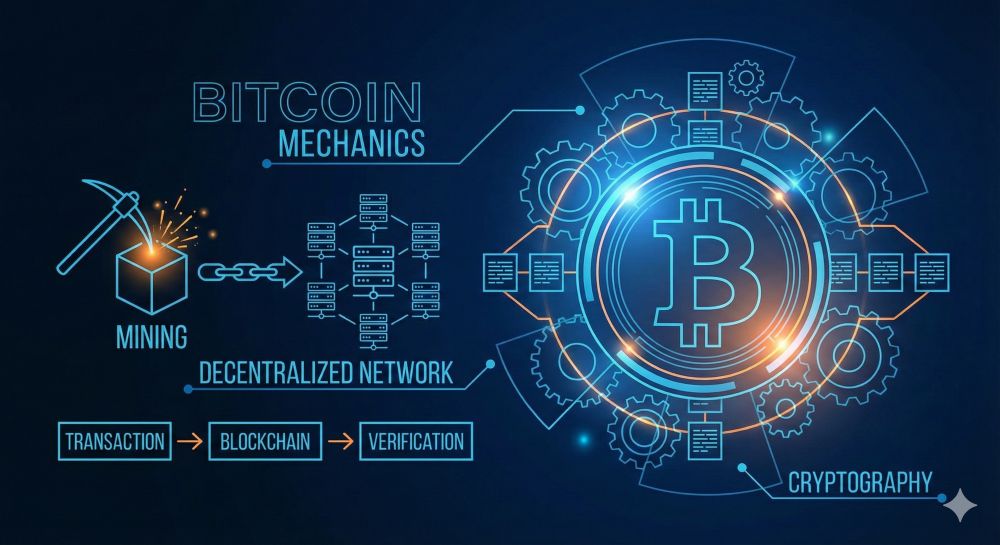

Apple Tap to Pay uses Near Field Communication (NFC) technology, built into most recent iPhone models. Customers can simply hold their iPhone or Apple Watch up to the retailer’s iPhone to make a payment. The transaction is then processed via the Apple Pay platform, known for its security and ease of use.

- The launch of this feature in Europe is expected to further increase the adoption of contactless payments. At a time when many people are trying to avoid physical contact for health reasons, Apple Tap to Pay offers a safe and convenient alternative to cash or cards.

- However, Apple Tap to Pay is only available on certain iPhone models. Merchants must also integrate the Apple Pay platform with their payment systems to use this feature. A full list of compatible devices can be found here: https://support.apple .com/de-de/HT208531

Despite these requirements, the launch of Apple Tap to Pay in Europe (UK only for now) is an important step towards an increasingly digital and contactless payments landscape. This development is expected to bring benefits to both consumers and retailers.

How to use Apple ‘Tap to Pay’:

Using Apple Tap to Pay is as simple as Apple users are used to, and is similar to the procedure of other payment service providers such as PayPal or Google Pay:

- Check your device’s compatibility: Apple Tap to Pay is only available on certain iPhone models that support the necessary NFC technology. You must have an iPhone 6 or later model to use Apple Pay. Here is the compatibility list: https://support.apple.com/de -de/HT208531

- Set up Apple Pay: If you haven’t already set up Apple Pay, open the Wallet App on your iPhone, tap the plus sign and follow the prompts to add your credit or debit card. You may need to contact your bank or card issuer to verify the card.

- Set up payments: If you’re a merchant and want to use Apple Tap to Pay to accept payments, make sure you’re using the latest version of iOS and the Apple Pay platform integrated into your payment systems. Customers can then simply tap their iPhone or Apple Watch to your device to make a payment.

- Accept payment: As soon as the customer touches their device to your iPhone, a notification will appear on your screen. You must then confirm the payment by tapping the “Accept” button.

- Payment Confirmation: After the payment is completed, you will receive a confirmation on your screen and a receipt will be automatically sent to the customer.

Apple Tap to Pay uses Near Field Communication (NFC) technology, built into most recent iPhone models. Customers can simply hold their iPhone or Apple Watch up to the retailer’s iPhone to make a payment. The transaction is then processed via the Apple Pay platform, known for its security and ease of use.

- The launch of this feature in Europe is expected to further increase the adoption of contactless payments. At a time when many people are trying to avoid physical contact for health reasons, Apple Tap to Pay offers a safe and convenient alternative to cash or cards.

- However, Apple Tap to Pay is only available on certain iPhone models. Merchants must also integrate the Apple Pay platform with their payment systems to use this feature. A full list of compatible devices can be found here: https://support.apple .com/de-de/HT208531

Despite these requirements, the launch of Apple Tap to Pay in Europe (UK only for now) is an important step towards an increasingly digital and contactless payments landscape. This development is expected to bring benefits to both consumers and retailers.

How to use Apple ‘Tap to Pay’:

Using Apple Tap to Pay is as simple as Apple users are used to, and is similar to the procedure of other payment service providers such as PayPal or Google Pay:

- Check your device’s compatibility: Apple Tap to Pay is only available on certain iPhone models that support the necessary NFC technology. You must have an iPhone 6 or later model to use Apple Pay. Here is the compatibility list: https://support.apple.com/de -de/HT208531

- Set up Apple Pay: If you haven’t already set up Apple Pay, open the Wallet App on your iPhone, tap the plus sign and follow the prompts to add your credit or debit card. You may need to contact your bank or card issuer to verify the card.

- Set up payments: If you’re a merchant and want to use Apple Tap to Pay to accept payments, make sure you’re using the latest version of iOS and the Apple Pay platform integrated into your payment systems. Customers can then simply tap their iPhone or Apple Watch to your device to make a payment.

- Accept payment: As soon as the customer touches their device to your iPhone, a notification will appear on your screen. You must then confirm the payment by tapping the “Accept” button.

- Payment Confirmation: After the payment is completed, you will receive a confirmation on your screen and a receipt will be automatically sent to the customer.

Effects on the European market

Effects on the European market

The arrival of Apple Tap to Pay in Europe could have a significant impact on the digital payments market. It offers small businesses and merchants a cost-effective way to accept contactless payments without having to invest in expensive hardware. Additionally, the launch of Apple Tap to Pay could boost competition in the industry. Other digital payment solution providers are likely to develop similar features to compete with Apple.

“For consumers, the launch of Apple Tap to Pay means more convenience and flexibility. Now you can use your iPhone or Apple Watch to pay at more stores than ever before without having to show your card or carry cash.”

Apple Tap to Pay is driving digital payments

- Increased acceptance of contactless payments: With the launch of Apple Tap to Pay, more merchants and consumers could be encouraged to accept and use contactless payments. This could lead to contactless payments becoming even more common in Europe.

- Changing competitive landscape: Apple Tap to Pay could increase competition among digital payment solution providers. Other companies may be pushed to develop similar features to compete with Apple.

- Increased adoption of Apple Pay: Although Apple Pay is already available in many European countries, some consumers and merchants have been reluctant to use it. With the launch of Apple Tap to Pay, that could change as the feature makes using Apple Pay even easier and more convenient.

- Benefits for Small Businesses: Small businesses and merchants could particularly benefit from the introduction of Apple Tap to Pay. The feature allows them to accept contactless payments without having to invest in expensive hardware. This could help reduce operational costs and increase efficiency.

- Changes in consumer behavior: The introduction of Apple Tap to Pay could also affect consumer behavior. Consumers could be encouraged to use their smartphone for payments more often, leading to another Digitization of payment transactions.

Reading tip: The digital euro and the E -Wallet duty coming

The arrival of Apple Tap to Pay in Europe could have a significant impact on the digital payments market. It offers small businesses and merchants a cost-effective way to accept contactless payments without having to invest in expensive hardware. Additionally, the launch of Apple Tap to Pay could boost competition in the industry. Other digital payment solution providers are likely to develop similar features to compete with Apple.

“For consumers, the launch of Apple Tap to Pay means more convenience and flexibility. Now you can use your iPhone or Apple Watch to pay at more stores than ever before without having to show your card or carry cash.”

Apple Tap to Pay is driving digital payments

- Increased acceptance of contactless payments: With the launch of Apple Tap to Pay, more merchants and consumers could be encouraged to accept and use contactless payments. This could lead to contactless payments becoming even more common in Europe.

- Changing competitive landscape: Apple Tap to Pay could increase competition among digital payment solution providers. Other companies may be pushed to develop similar features to compete with Apple.

- Increased adoption of Apple Pay: Although Apple Pay is already available in many European countries, some consumers and merchants have been reluctant to use it. With the launch of Apple Tap to Pay, that could change as the feature makes using Apple Pay even easier and more convenient.

- Benefits for Small Businesses: Small businesses and merchants could particularly benefit from the introduction of Apple Tap to Pay. The feature allows them to accept contactless payments without having to invest in expensive hardware. This could help reduce operational costs and increase efficiency.

- Changes in consumer behavior: The introduction of Apple Tap to Pay could also affect consumer behavior. Consumers could be encouraged to use their smartphone for payments more often, leading to another Digitization of payment transactions.

Reading tip: The digital euro and the E -Wallet duty coming

Popular Posts

The best AI text recognition tools compared

KI-Texte von ChatGPT und Co. sind allgegenwärtig. Doch wie unterscheiden Sie Mensch von Maschine? Wir vergleichen die Top-Tools wie Originality.ai und GPTZero. Erfahren Sie, welcher Detektor am genauesten ist und wo die technischen Grenzen der KI-Erkennung liegen.

Schatten-KI: Die undichte Stelle im Browser

Nutzen Ihre Mitarbeiter heimlich ChatGPT? Schatten-KI ist das unsichtbare Risiko für Ihre Datensicherheit. Sensible Infos landen oft auf fremden Servern. Lesen Sie, warum reine Verbote scheitern und wie Sie mit smarten Richtlinien Ihre Daten schützen, ohne Innovation zu bremsen.

Meta in court: Will the subscription requirement now be overturned?

Those who want an ad-free Facebook experience have to pay – or agree to extensive tracking. A lawsuit challenging this model is now underway. Will the mandatory subscription model be overturned in court? Find out why consumer advocates consider the practice illegal and what this means for users.

Cybersicherheit: Die 3 größten Fehler, die 90% aller Mitarbeiter machen

Hacker brauchen keine Codes, sie brauchen nur einen unaufmerksamen Mitarbeiter. Von Passwort-Recycling bis zum gefährlichen Klick: Wir zeigen die drei häufigsten Fehler im Büroalltag und geben praktische Tipps, wie Sie zur menschlichen Firewall werden.

Here’s how to protect your content from AI training.

AI models often train on your content without your permission. But you're not powerless. This article shows you effective strategies – from technical opt-outs and "poison pills" for image AI to closed paywalls – to regain control over your intellectual property.

How we all turned Google into our monopolist

Google's monopoly is homegrown – created by us. We chose the superior search engine, "free" services like Gmail and Maps, and ignored the competition. In exchange for convenience, we gave away our data and created the monopolist ourselves.

Popular Posts

The best AI text recognition tools compared

KI-Texte von ChatGPT und Co. sind allgegenwärtig. Doch wie unterscheiden Sie Mensch von Maschine? Wir vergleichen die Top-Tools wie Originality.ai und GPTZero. Erfahren Sie, welcher Detektor am genauesten ist und wo die technischen Grenzen der KI-Erkennung liegen.

Schatten-KI: Die undichte Stelle im Browser

Nutzen Ihre Mitarbeiter heimlich ChatGPT? Schatten-KI ist das unsichtbare Risiko für Ihre Datensicherheit. Sensible Infos landen oft auf fremden Servern. Lesen Sie, warum reine Verbote scheitern und wie Sie mit smarten Richtlinien Ihre Daten schützen, ohne Innovation zu bremsen.

Meta in court: Will the subscription requirement now be overturned?

Those who want an ad-free Facebook experience have to pay – or agree to extensive tracking. A lawsuit challenging this model is now underway. Will the mandatory subscription model be overturned in court? Find out why consumer advocates consider the practice illegal and what this means for users.

Cybersicherheit: Die 3 größten Fehler, die 90% aller Mitarbeiter machen

Hacker brauchen keine Codes, sie brauchen nur einen unaufmerksamen Mitarbeiter. Von Passwort-Recycling bis zum gefährlichen Klick: Wir zeigen die drei häufigsten Fehler im Büroalltag und geben praktische Tipps, wie Sie zur menschlichen Firewall werden.

Here’s how to protect your content from AI training.

AI models often train on your content without your permission. But you're not powerless. This article shows you effective strategies – from technical opt-outs and "poison pills" for image AI to closed paywalls – to regain control over your intellectual property.

How we all turned Google into our monopolist

Google's monopoly is homegrown – created by us. We chose the superior search engine, "free" services like Gmail and Maps, and ignored the competition. In exchange for convenience, we gave away our data and created the monopolist ourselves.