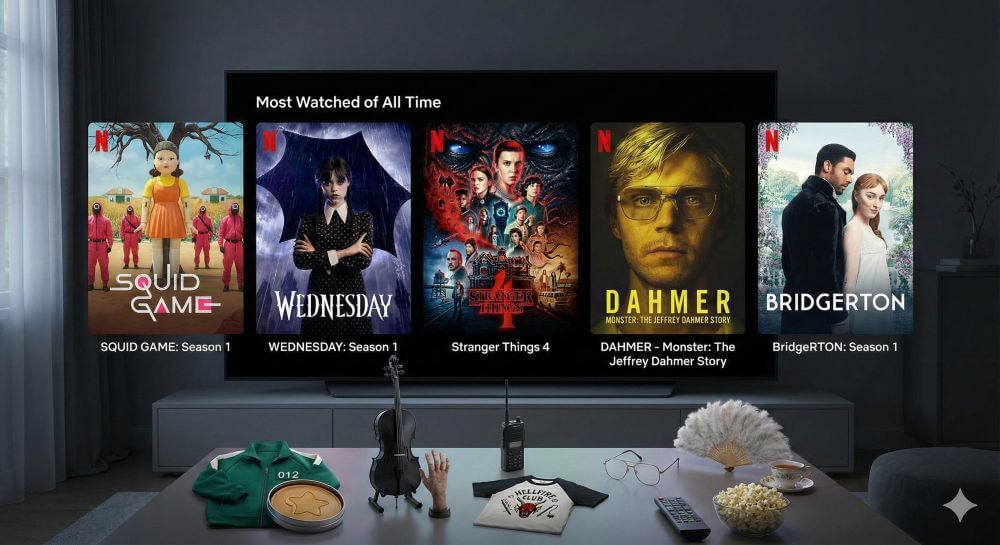

The Great Feast: Who will survive the streaming war?

The streaming market is like an overcrowded lifeboat. For years, more and more providers crowded in, but now the air is running out. Billions in losses, desperate takeover rumors, and the demise of smaller services: Consolidation has begun. For customers, this means things are about to get uncomfortable.

The golden age of unbridled growth is over. For years, “subscriber growth” was the only thing that mattered on the stock market. Money was burned as if there were no tomorrow—hundreds of millions for individual series, billions for sports rights.

Now the hangover has arrived. Investors no longer want to see subscribers; they want profit. And that is in short supply.

The Patient: Disney+ and the billions in losses

Even the world’s largest entertainment giant isn’t immune. Disney’s streaming business (Disney+, Hulu, ESPN+) has cost the company billions in losses over the years. While it’s approaching profitability, the road there has been brutal: mass layoffs, drastic price increases, and the infamous “purging”—removing dozens of films and series from its own platform to save on licensing costs and residual value.

If even Disney is struggling, how can the rest possibly survive?

The Battlefield: The Hunters and the Hunted

Customer “subscription fatigue” is real. Nobody wants to subscribe to eight different services. The market is saturated and will inevitably correct itself. There are clear hunters and clear hunted.

The Hunted (Wrinkle Candidates):

- At the top of the list is Paramount+. The service (home to “Star Trek,” “Yellowstone” spin-offs, and Top Gun) is too small to compete globally with the giants, but too big to serve a niche. For months, takeover rumors have been circulating in the industry. Skydance, Sony, Apollo – all seem interested in parts of the company. Warner Bros. Discovery (HBO Max) is also heavily indebted and considered a potential merger candidate.

- Smaller services like Lionsgate+ (Starz) have already completely withdrawn from Germany.

The Hunters (The Giants): Who has the money to clean up?

- Apple (Apple TV+): Sitting on unimaginable mountains of cash and could buy any competitor (like Paramount or Disney) if they wanted to.

- Amazon (Prime Video): Already swallowed MGM and proved it’s willing to dig deep into its pockets for catalogs.

- Netflix: Is the only “pure” streaming service that’s profitable.

What consolidation means for customers

- When services merge or die, it means… Rarely a pure win for the customer:

- Content disappears: If Paramount is bought by (e.g.) Sony, what happens to the licenses? Series vanish overnight when they are “cleaned out” of libraries during a merger.

- Prices rise: Less competition means higher prices. If only 3-4 “super services” remain, they can dictate prices.

- The return of bundles: The most likely future. Instead of individual apps, we see mandatory bundles. This is already happening in the US (e.g., Disney+ & Hulu). In Germany, telecommunications providers (Telekom, Vodafone) could become important again, bundling various services.

The fragmentation was annoying. The consolidation now beginning will be even more turbulent. The “Wild West” of streaming is over – the feeding frenzy has begun.

The agony of choice for streaming customers

For consumers, 2026 means one thing above all: The fragmentation of the streaming market continues.

The “decision” customers are facing is uncomfortable. They have to weigh up what’s more important to them:

- Stay with Sky/WOW: To finish watching current HBO hits like “House of the Dragon” while still having access to the Bundesliga, sports, and new Sony content.

- Switch to HBO Max (or subscribe to it in addition): To get access to the latest top series (like “Harry Potter”) and the entire, extensive catalogs of HBO and Warner (including DC and Discovery+).

It’s highly likely that many series fans will need two subscriptions in the future, where one was previously sufficient. The “bombshell” of 2026 is therefore not only a problem for Sky, but also for the wallets of German streaming users.

Beliebte Beiträge

From assistant to agent: Microsoft’s Copilot

Copilot is growing up: Microsoft's AI is no longer an assistant, but a proactive agent. With "Vision," it sees your Windows desktop; in M365, it analyzes data as a "Researcher"; and in GitHub, it autonomously corrects code. The biggest update yet.

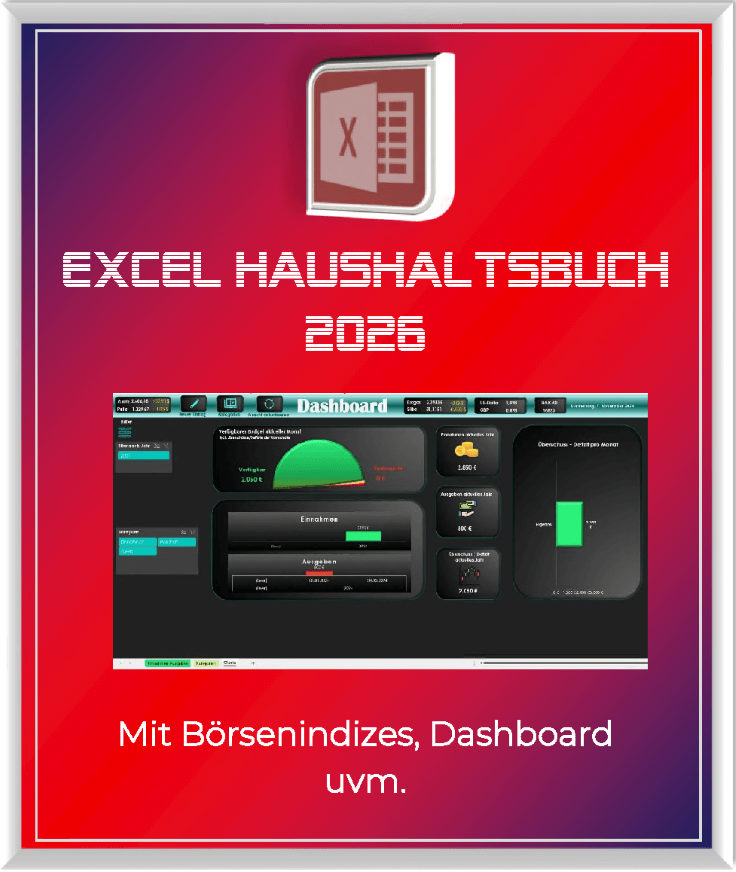

Never do the same thing again: How to record a macro in Excel

Tired of repetitive tasks in Excel? Learn how to create your first personal "magic button" with the macro recorder. Automate formatting and save hours – no programming required! Click here for easy instructions.

IMAP vs. Local Folders: The secret to your Outlook structure and why it matters

Do you know the difference between IMAP and local folders in Outlook? Incorrect use can lead to data loss! We'll explain simply what belongs where, how to clean up your mailbox, and how to archive emails securely and for the long term.

Der ultimative Effizienz-Boost: Wie Excel, Word und Outlook für Sie zusammenarbeiten

Schluss mit manuellem Kopieren! Lernen Sie, wie Sie Excel-Listen, Word-Vorlagen & Outlook verbinden, um personalisierte Serien-E-Mails automatisch zu versenden. Sparen Sie Zeit, vermeiden Sie Fehler und steigern Sie Ihre Effizienz. Hier geht's zur einfachen Anleitung!

Microsoft 365 Copilot in practice: Your guide to the new everyday work routine

What can Microsoft 365 Copilot really do? 🤖 We'll show you in a practical way how the AI assistant revolutionizes your daily work in Word, Excel & Teams. From a blank page to a finished presentation in minutes! The ultimate practical guide for the new workday. #Copilot #Microsoft365 #AI

Integrate and use ChatGPT in Excel – is that possible?

ChatGPT is more than just a simple chatbot. Learn how it can revolutionize how you work with Excel by translating formulas, creating VBA macros, and even promising future integration with Office.