Bitcoin & Co.: Technology, price mechanisms and the market beyond number one

Bitcoin is no longer just “digital play money” for nerds. Since the establishment of spot ETFs and the full implementation of European MiCA regulations, the cryptocurrency has arrived in the institutional financial sector. But how does this “digital gold” actually work technically?

In this article, we’ll take a closer look at what drives the price in this more mature market phase and what alternatives still play a role today.

A deep dive.

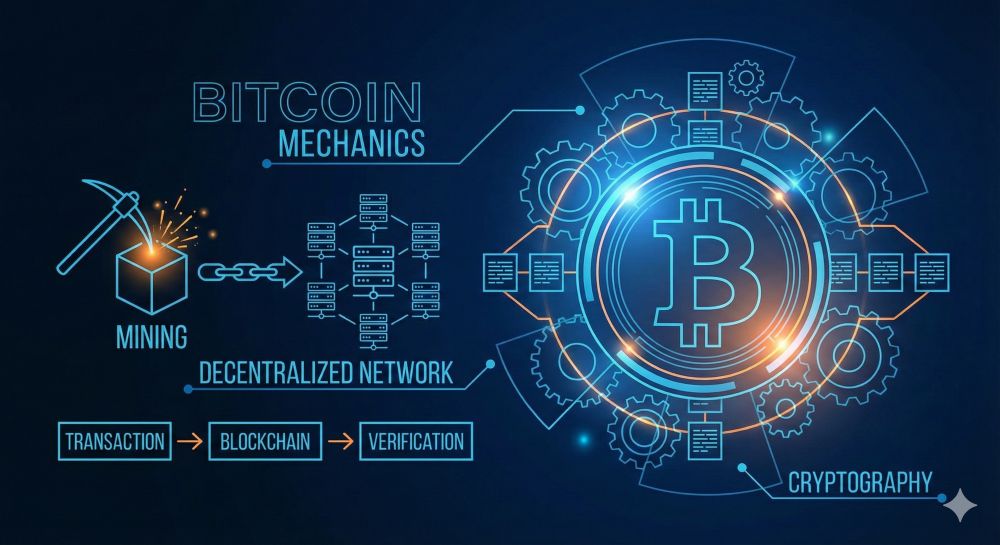

The engine room: How Bitcoin works technically

Market dynamics: What influences the Bitcoin price?

Previously, it was tweets from Elon Musk or Chinese bans that steered the price. By 2025, the influencing factors have become more “mature.”

A. Supply and Demand (ETF Effect)

Since the approval of major spot ETFs in the US (by BlackRock, Fidelity, etc.), billions in institutional capital have flowed into the market. These funds need to buy physical Bitcoins to cover their holdings. If the supply decreases due to the halving, but demand from ETFs and savings plans remains the same or increases, the price must mathematically rise.

B. Macroeconomics & Interest Rate Policy

Bitcoin is now strongly correlated with global liquidity.

- Interest Rate Cuts: When central banks (FED, ECB) cut interest rates, money becomes cheaper. Investors are seeking yield and fleeing government bonds into risk assets (stocks, tech, crypto).

- Inflation protection: Many companies use Bitcoin as a hedge against currency devaluation.

C. Regulation (Legal Clarity)

For a long time, regulation was a bogeyman. By 2025, it will be a driver of share prices. MiCA (Markets in Crypto-Assets): This EU regulation has made Europe the safest haven for crypto companies. Banks are now officially allowed to offer custody services, which strengthens the confidence of conservative investors.

Beyond Bitcoin: The most important altcoins

While Bitcoin is considered “digital gold” (a store of value), other cryptocurrencies have different functions. They are called altcoins.

Ethereum (ETH) – The World Computer

Ethereum is the second-largest cryptocurrency and technologically completely different from Bitcoin.

- Smart Contracts: Ethereum enables programmable contracts. Applications (DApps), such as decentralized exchanges or lending platforms (DeFi), are based on these.

- Difference: While Bitcoin is “dead” money that you hold, Ether (ETH) is the “fuel” to use the Ethereum network.

Solana (SOL) – The High-Speed Alternative

Solana has firmly established itself as a competitor to Ethereum by 2025.

- Advantage: Extremely fast and inexpensive transactions.

- Disadvantage: The network is considered more centralized and less stable than Ethereum or Bitcoin. It is often used for gaming applications and NFTs.

Stablecoins (USDT, USDC) – The Bridge to the Dollar

Perhaps most relevant for everyday office life: stablecoins.

- They are pegged 1:1 to currencies such as the US dollar or euro.

- They offer the speed of the blockchain without the volatility of Bitcoin. They will play an increasingly important role in international B2B payments by 2025.

How can anyone participate in the world of cryptocurrencies?

In 2025/2026, access to cryptocurrencies will be easier than ever. You no longer need to be an IT expert to become part of the ecosystem. The market has professionalized, and the barriers have fallen. Here are the three most common ways to get involved today.

A. The Investor’s Path: Buy, Hold, Savings Plans

This is the classic entry point for 90% of people.

- Crypto Exchanges & Brokers: You can exchange euros for Bitcoin via regulated platforms (such as Bitpanda, Coinbase, or the German stock exchange Stuttgart Digital). Important: Thanks to MiCA regulation, you now have to fully verify your identity everywhere (video identification). “Anonymous buying” is a thing of the past with reputable providers.

- The ETF Path: Those who don’t want to deal with the technology can simply buy crypto through their regular brokerage account. Bitcoin ETPs, or ETFs, are tradable with almost every online broker (such as Trade Republic or Scalable). You participate in the price movement but do not physically own the coins.

- The savings plan strategy: To offset the high volatility, many investors use automated savings plans (dollar-cost averaging). Purchases are made automatically starting from as little as 10 or 20 euros per month – regardless of whether the price is currently high or low.

B. The “Pro” Way: Self-Custody and Staking

Those who want to delve deeper leave the exchanges and take control of their coins themselves.

- Be your own bank (wallets): With a hardware wallet (like Ledger or BitBox02), you store your private keys offline. The principle “Not your keys, not your coins” still applies in 2025. This protects you from the bankruptcy of trading platforms.

- Staking (earning interest): On networks like Ethereum or Solana, you can make your coins available to the network for security (“staking”). In return, you receive a kind of dividend (rewards). This is often done with a single click directly in the wallet app, but it comes with tax implications (in Germany, a holding period of often one year is required for tax exemption).

C. The Career Path: Working in the Web3 World

“Getting involved” doesn’t have to mean investing money. You can also invest your time and skills. The sector is desperately seeking personnel!

- Non-Tech Jobs: Blockchain companies don’t just need programmers. Lawyers for compliance, marketing managers for community building, and controllers are in extremely high demand.

- Education: Those who pursue further education in blockchain topics today (e.g., certificates from the Frankfurt School of Finance or online courses) are enhancing their resume for the modern job market.

Conclusion and Outlook

Critics and media educators warn of the negative consequences of a blanket ban:

Organizations such as the Federal Agency for Child and Youth Media Protection emphasize that, according to Article 17 of the UN Convention on the Rights of the Child, children have a right to participate in media. A ban for those under 16 would exclude them from an important social communication space. Critics fear that a strict age limit would leave young people unprepared for the digital adult world. The focus should instead be on enhanced media literacy in schools and better parental guidance.

Due to the ease with which such a ban can be circumvented, many fear that the law will only have a symbolic effect instead of providing genuine protection.

Sources and Further Reading

To verify the information in this article, the following primary and secondary sources were consulted:

- Satoshi Nakamoto (2008): “Bitcoin: A Peer-to-Peer Electronic Cash System.” (The original whitepaper, which describes the technical foundation).

- European Union / BaFin (2023/2024): Markets in Crypto Assets Regulation (MiCA). (Basis for the regulatory framework and legal certainty in the EU).

- BlackRock / iShares (2025): “Digital Assets Market Outlook.” (For information on institutional money flows and ETFs).

- CoinGecko / Glassnode: On-chain data and market capitalizations. (Source for data on halving cycles and mining activity).

- Ethereum Foundation: Documentation on Smart Contracts and Proof-of-Stake.

- Stuttgart Stock Exchange (Bison App) / BaFin: Consumer information on crypto custody and licensing in Germany.

- Ledger Academy: “Self-Custody: Why it matters in 2025.” (Educational material on secure custody).

- Federal Ministry of Finance (BMF): Individual letter on the income tax treatment of virtual currencies and other tokens. (Regarding the tax aspects of staking and holding periods).

- Image material: Google Nano Banana AI

Beliebte Beiträge

Warum dein Excel-Kurs Zeitverschwendung ist – was du wirklich lernen solltest!

Hand aufs Herz: Wann hast du zuletzt eine komplexe Excel-Formel ohne Googeln getippt? Eben. KI schreibt heute den Code für dich. Erfahre, warum klassische Excel-Trainings veraltet sind und welche 3 modernen Skills deinen Marktwert im Büro jetzt massiv steigern.

Microsoft Loop in Teams: The revolution of your notes?

What exactly are these Loop components in Microsoft Teams? We'll show you how these "living mini-documents" can accelerate your teamwork. From dynamic agendas to shared, real-time checklists – discover practical use cases for your everyday work.

Career booster 2026: These Microsoft Office skills will take you further!

A new year, new career opportunities! But which Office skills will really be in demand in 2026? "Skilled use" is no longer enough. We'll show you today's must-haves – like advanced Excel, using AI in the office, and relevant certifications for your resume.

Excel Tutorial: How to quickly and safely remove duplicates

Duplicate entries in your Excel lists? This distorts your data. Our tutorial shows you, using a practical example, how to clean up your data in seconds with the "Remove Duplicates" function – whether you want to delete identical rows or just values in a column.

Dynamic ranges in Excel: OFFSET function

The OFFSET function in Excel creates a flexible reference. Instead of fixing =SUM(B5:B7), the function finds the range itself, e.g., for the "last 3 months". Ideal for dynamic charts or dashboards that grow automatically.

Mastering the INDIRECT function in Excel

The INDIRECT function in Excel converts text into a real reference. Instead of manually typing =January!E10, use =INDIRECT(A2 & "!E10"), where A2 contains 'January'. This allows you to easily create dynamic summaries for multiple worksheets.